Development Solutions: Credit where it’s overdue

By Moa Westman and Sabine Kayser

Women are at the heart of the Ugandan economy. They own almost 40% of all registered businesses, giving Uganda the highest concentration of female-owned businesses in the world. But Ugandan women often don’t get the support they need for their businesses to thrive. Women-owned businesses only account for a sliver — 9% — of commercial credit issued in the country.

An international initiative, the 2X Challenge, aims to change that. Launched in 2019, the 2X Challenge represents commitments by the G 7 industrialised nations to mobilise billions to fund women’s economic empowerment in developing countries. As of July, the 2X Challenge had committed and mobilised $4.5 billion.

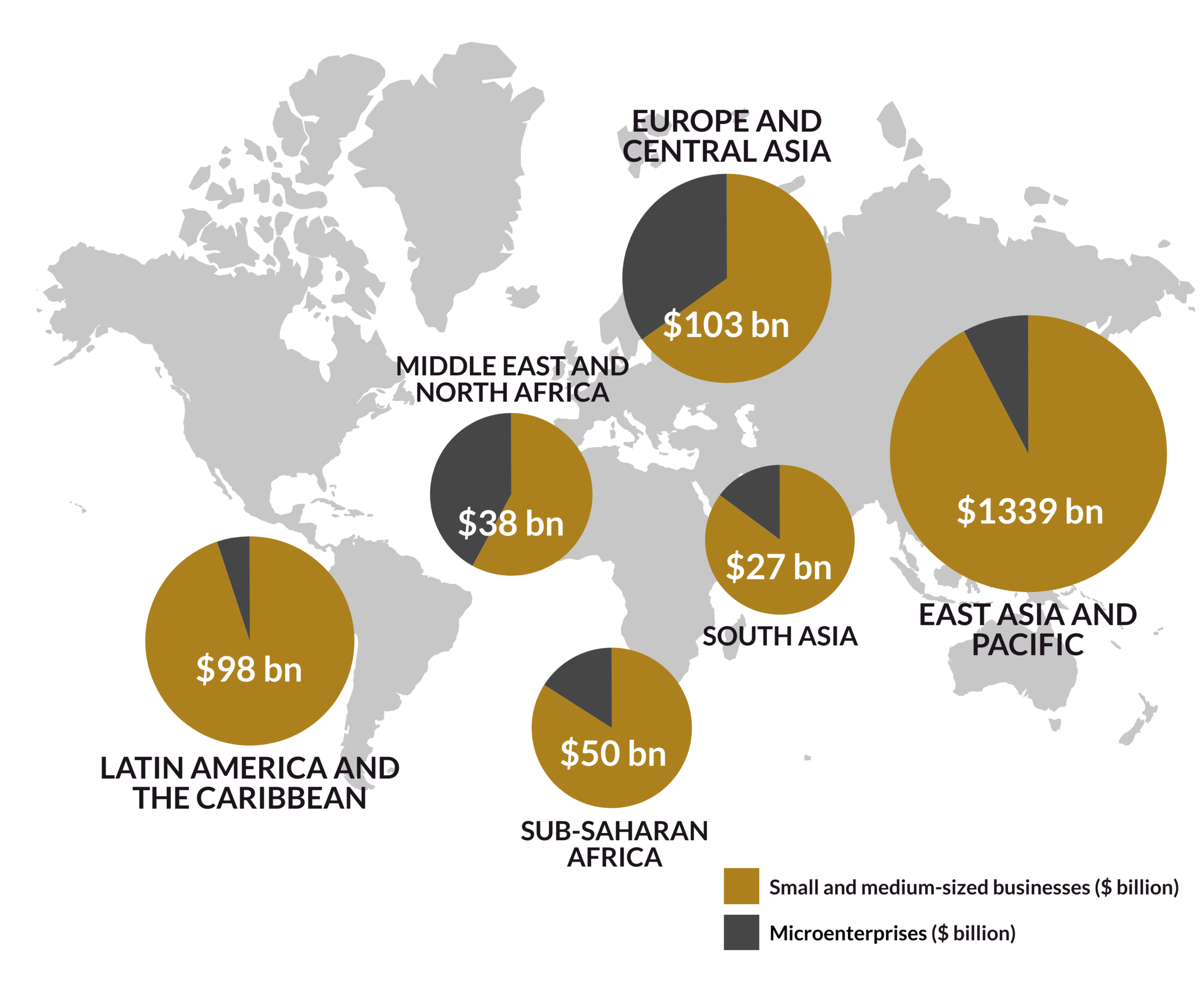

The European Investment Bank adopted the 2X Challenge criteria in October 2019 and at the same time announced, SheInvest, its own commitment to mobilise €1 billion of gender-responsive investments across Africa. Initiatives like SheInvest and the 2X Challenge are trying to fill an estimated $1.7 trillion financing gap worldwide for micro, small and medium-sized businesses owned and run by women.

In December 2019, the European Investment Bank signed the first loan under the SheInvest initiative—to the Uganda Development Bank (UDB). The UDB received €15 million, almost one-third of which will go to supporting women-owned and women-run businesses. To find those candidates, UDB will apply the 2X Challenge’s investment criteria on female entrepreneurship, leadership, employment and consumption.

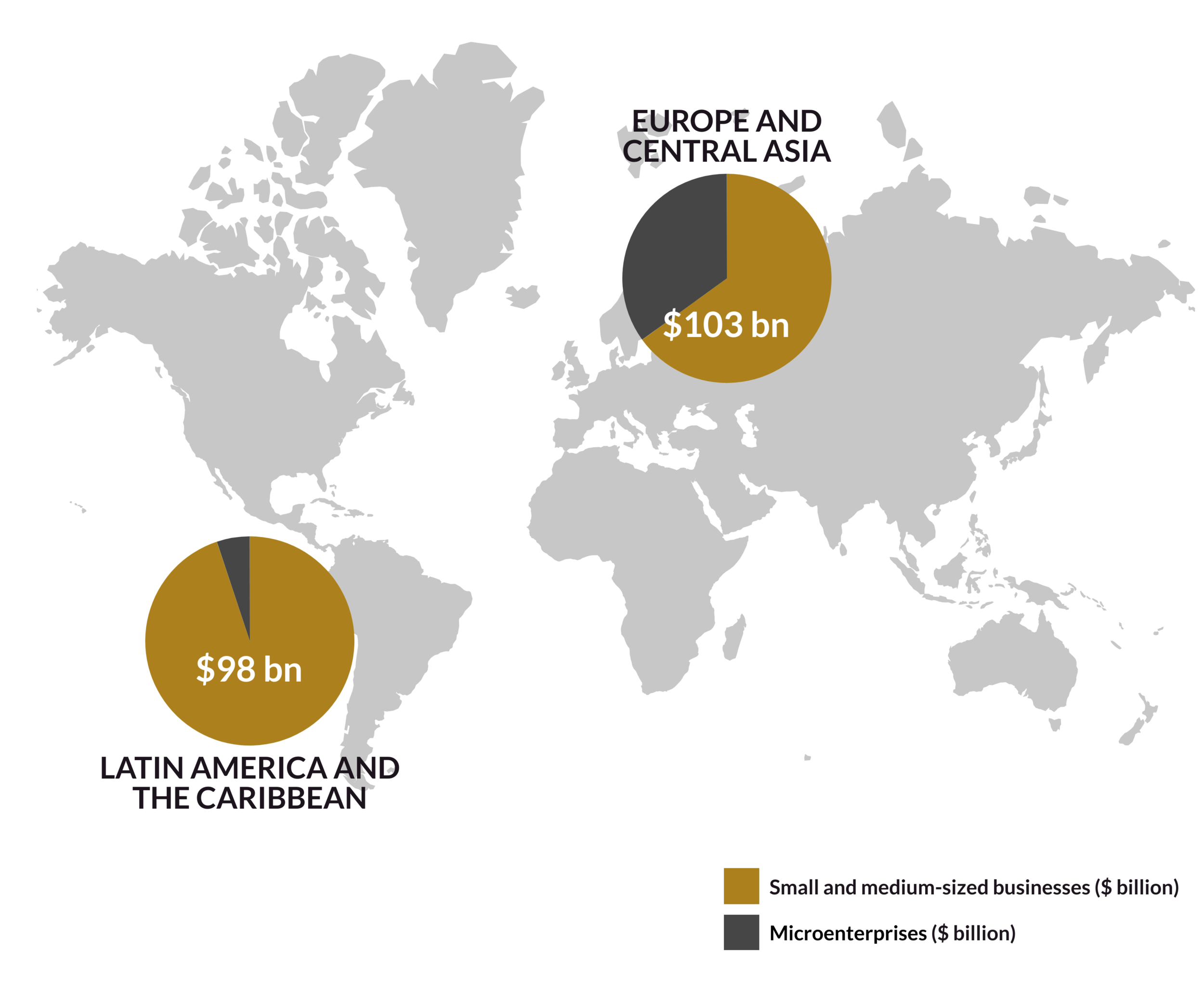

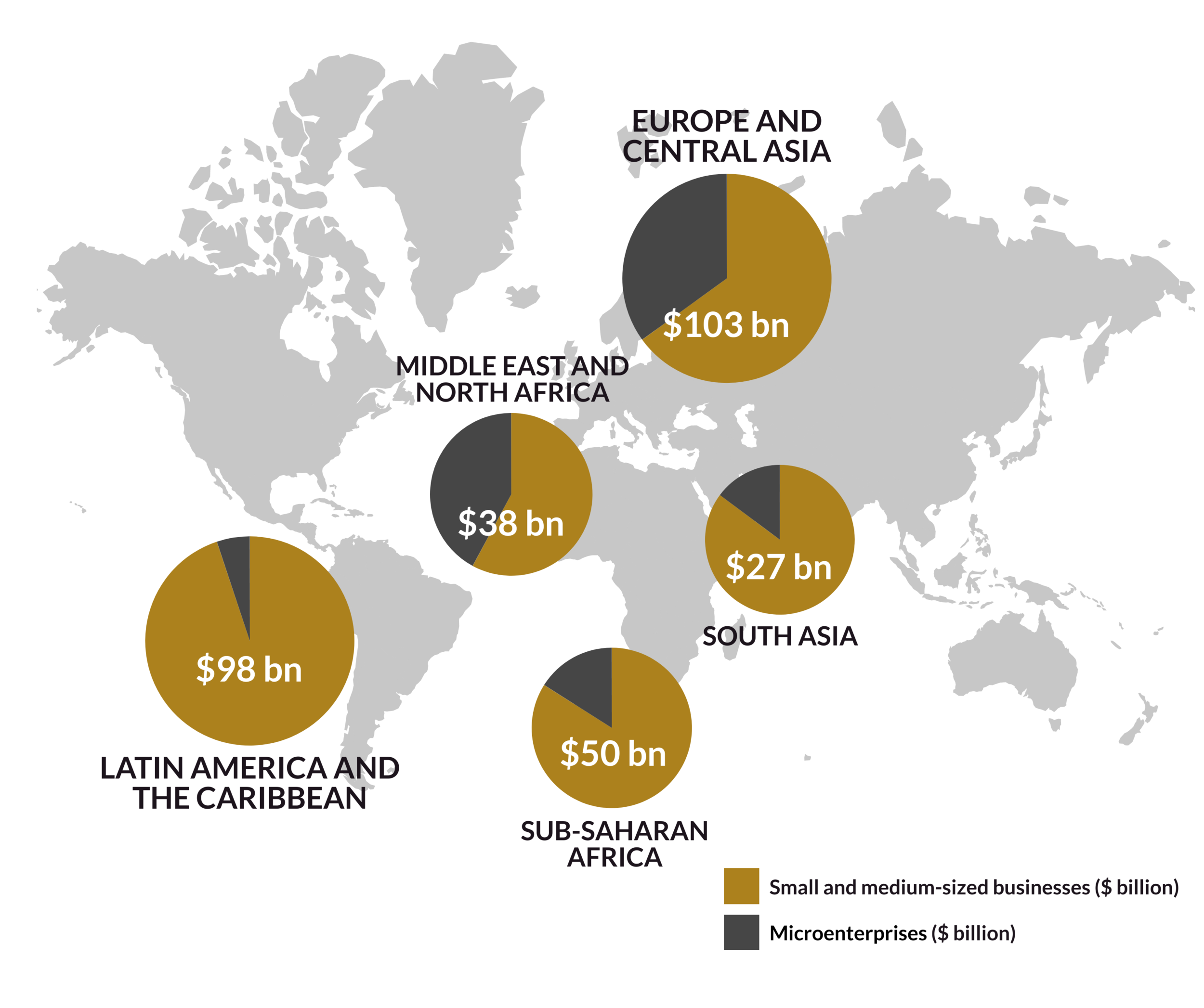

Unmet Credit Needs, a Yawning Gap

The unmet credit needs of women-owned and led small businesses ($ billion)

©EIB

Source: IFC

Women-owned businesses account for almost a third of businesses worldwide, according to the International Finance Corporation. Female-owned and led firms, however, account for more than their share of the finance gap traditionally faced by small businesses. An estimated 68% of businesses owned or led by women have unmet credit needs.

The gender credit gap shouldn’t exist. After all, there’s ample evidence that women are prudent borrowers and often have better repayment rates than men. Enterprises with women in at least half of leadership positions have been shown to have higher sales growth, earnings per share and return on assets – and during times of crisis, their company share price performs better.

“Globally the odds are still stacked against women entrepreneurs,” says Jessica Espinoza Trujano, chairwoman of the 2X Challenge. “Companies founded by women receive less than half as much funding as those founded by men, although they deliver twice as much revenue per dollar invested.”

Companies founded by women receive less than half as much funding as those founded by men, although they deliver twice as much revenue per dollar invested.

It isn’t business performance that often curtails women’s access to credit. It’s discrimination. In some countries, that discrimination is codified in local laws. For example, a woman may need her husband’s approval before taking out a loan or may not be allowed to own property. In other countries, discrimination is rooted in social customs or norms, which leads to an unconscious bias on the part of lenders.

Preventing women from establishing and growing their businesses limits their financial independence and leads to inequality across society. Female-owned businesses are traditionally big employers of women, which means that credit discrimination touches more than just female entrepreneurs—it limits the economic participation of all women.

There is another important aspect to this problem that is often overlooked. Promoting female-owned and led business pulls more women into the formal economy.

Women tend to be overrepresented in the informal economy, with its precarious employment and lack of a social safety net. Globally, nearly 40% of women in wage-earning employment do not have access to social protections such as unemployment insurance, pension or paid maternity leave. That figure rises to 63% in sub-Saharan Africa, according to the International Labour Organization.

SheInvest empowers women in Africa

The European Investment Bank launched its SheInvest initiative in November 2019 to boost gender equality and female economic empowerment. In addition to promoting women’s access to finance, the initiative also aims to support gender-responsive climate financing, acknowledging women’s contribution to climate action and the unique ways climate change affects them. Investments will support access to clean, reliable and affordable energy and improve women’s access to crucial infrastructure like running water and low-carbon, safe public transport. The 2X Challenge criteria will guide SheInvest projects.

Some recently signed EIB investments illustrate how SheInvest is making a difference.

Change from within

The Pan-African private equity group, Development Partners International (DPI), invests in some of the continent’s biggest names, like the home furnishings retailer HomeChoice in South Africa or Nigerian quick restaurant chain Food Concepts, which operates Chicken Republic, one of the fastest growing chains in West Africa. Its newest fund, African Development Partners III, is aligning itself with the criteria laid out in the 2X Challenge, committing to women’s economic advancement and a balanced gender representation.

Development Partners leads by example. The chief executive and co-founder, Runa Alam, is female, as is half of the company’s partners and Investment Committee. Women also account for almost half of employees. Founded in 2007, Development Partners manages $1.6 billion in assets.

Development Partners uses its influence to push for change in companies – at the board and among management teams. At Food Concepts, DPI worked with the company to promote women at every level, says Marc Stoneham, Portfolio Manager at DPI. “We’re very proud that four of the seven members of executive committee are female – and equally at the number of women being promoted from the shop floor into managerial positions.” A majority, 53%, of Food Concepts’ employees are female, he said.

David Butler, managing director of Food Concepts, said the company had also increased the number of women-owned and led businesses it used as suppliers. “We are working hard now to build gender balance into our supply chain,” he said. “And we are focusing on some really strategic areas of our business such as construction and logistics.”

Development Partners plans to increase its focus on gender in its third fund, helping to meet the 2X Challenge requirements. “We’re not moving away from our investing strategy of targeting companies that benefit from the growth of the emerging middle class, or our strategy of delivering returns to our investors,” Alam says, “but we have further evolved our agenda to align with the 2X Challenge.”

Michael Hall, Sustainability Manager at DPI, says that the 2X Challenge pushes the private equity group to look at the opportunities offered women at its own funds as well as at its portfolio companies. “Given that DPI’s portfolio companies currently employ over 40,000 Africans, the opportunity we have is really exciting,” he says.

The European Investment Bank has committed $50 million to the new fund.

Micro loans in Senegal

Baobab Senegal traditionally provides microcredit to small firms, such as artisans, sellers in local markets, craftspeople and restaurateurs. Often, the businesses run by women are so small that they fail to interest normal banks. Women also face obstacles to providing collateral. Family assets may not be in their name, or they may need their husband’s approval for the loan.

Traditionally, microfinance associations have circumvented these obstacles by providing loans to groups of women, which were later parcelled out to individuals, says Mamadou Cissé, chief executive of Baobab Senegal. In Africa, women often use these groups as a depository for their savings, allowing them to build up funds for weddings, funerals and children’s education, in accounts that simulate traditional banks. Loaning larger sums to the group solved two main problems: it cut down microfinance firms’ administrative costs and got around the difficulties women faced in providing collateral.

Many female entrepreneurs have one main goal: to feed their family. Cissé says that in many cases, the primary breadwinner, usually the husband, doesn’t earn enough to cover basic expenses. Tiny loans to women-owned businesses help many families weather difficult times or a sudden loss in revenue, such as during the coronavirus pandemic. “It’s an activity that is close to our heart,” he says.

Tiny firms aren’t Baobab’s only clients, however. One entrepreneur started her beauty supply company with a €1 500 loan. Through a series of loans, she was able to expand her business and now has 21 employees that deliver beauty supplies throughout the country.

The European Investment Bank is supporting Baobab with a €7 million loan. Four fifths of that money will go to female clients. The funds will allow Baobab Senegal, which is part of the larger digital financial services company Baobab Group, to provide an estimated 17 200 loans to small-scale entrepreneurs.

Financial services in Sub-Saharan Africa

More than one billion women globally lack access to financial services, according to Women’s World Banking Capital. The group is launching a new fund to help change that.

The Women’s World Banking Capital Partners II Fund will make minority investments in financial service providers, promoting the participation of women as entrepreneurs, managers and employees, particularly in sub-Saharan Africa. The fund’s premise is simple: investing in women can yield a social and financial return.

Through its investments, the fund tries to influence how financial service providers’ respond to women’s needs. The first step is to make sure that the providers’ own employees are diverse. Companies that have more diversity tend to serve women better.

One past fund investment highlights the problem. A Pakistani provider of mobile financial services had trouble reaching female clients. It turned out that all the company’s sales representatives were men. The lack of female reps limited the contact with women, as potential female clients were unwilling to give their phone number to an unknown man.

Sometimes the issue is less about a diverse workforce and more about the special needs of female clients. A challenge worldwide is that women often don’t have a government issued ID, which may be required for a loan. Providing collateral presents another difficulty. The family home, for example, may not be registered in the wife’s name.

Women also spend a considerable amount of time taking care of children and the elderly. That makes it complicated to go to a bank branch to open an account or fill in a loan application, particularly in traditional bank branches where lines can be long. Those challenges are repeated across the world, but they are more pronounced in sub-Saharan Africa.

The fund has so far raised $75 million of its $100 million target. The European Investment Bank is investing $11.5 million.

Recovery with a gender lens

The 2X Challenge does more than just raise money for female businesses. The 2X criteria harmonises development institutions’ efforts by creating a global standard for gender financing.

The 2X criteria has provided the European Investment Bank with rigour and clarity in establishing what should count as financing for gender equality and, as such, supports the Bank’s own gender strategy. Applying the criteria also enables the European Investment Bank to better track our gender investments. Since January 2018, the Bank has provided over €430 million of financing inside and outside Europe that meet the criteria.

Rebuilding our economies after the coronavirus pandemic presents enormous challenges, but also a tremendous opportunity to support women’s economic participation. The 2X Challenge criteria should be incorporated into economic stimulus and recovery efforts to help promote female entrepreneurship and employment. The pandemic could provide a unique opportunity for women-owned businesses active in health care and online education. It could also encourage small businesses to improve their digital and online marketing skills to address the disruptions brought on by COVID-19.

Lack of credit limits women’s ability to contribute economically and socially. It also hobbles a society’s ability to face enormous challenges like poverty, climate change, and health crises like the current pandemic. Support for women’s economic empowerment is key to helping countries develop and create wealth.

Moa Westman is a gender specialist at the European Investment Bank Sabine Kayser is a senior policy officer.